Is it a good time to own a home in Singapore?

Does timing matter, or what factors are necessary to consider before we decide on the next purchase. Stay tuned to find out

Limited new launch opportunities vs available supply?

“In view of the limited new-launch pipeline in 2022, we expect new home sales to trend down from the current 13,000 units to a normalised 9,000 to 10,000 units, while prices could be flat or increase by 1 to 3 per cent in 2022.

Increase housing for owner occupiers. MND announced a 35% increase in BTO flat supply, from 17,000 in 2021 to 23,000 in 2022.

With hopefully more affordable HDB resale flats and more BTO flats to ballot for, that means 2022 should deliver more public housing options.

More competitive pricing for private and landed segments? This could be the case as demand gains from 2021 will spill over to 2022 and a lesser supply pool of ready units.

Change in cooling measures?

The additional buyer's stamp duty (ABSD) rates were raised by 5% to 15%, the total debt servicing ratio (TDSR) threshold was tightened to 55%, and the loan-to-value (LTV) limit for loans from the Housing Board (HDB) was lowered to 85%.

ABSD rates for the first residential property purchase by Singapore citizens and permanent residents (PRs) remain unchanged at 0% and 5% respectively. But the ABSD rates for all other individuals and entities were raised by 5% to 15%

Interest rates - Fixed or Floating loans?

SORA is replacing SOR and SIBOR as the SGD interest rate benchmark for use in financial contracts such as loans, bonds and derivatives. Published daily by the Monetary Authority of Singapore (MAS), SORA is a robust and reliable interest rate benchmark that is fully backed by overnight interbank cash transactions in Singapore.

This change will affect property owners who are considering or already have a floating rate property loan package. SOR will be discontinued after Jun 30, 2023; the six-month SIBOR will be discontinued after Mar 31, 2022; and the more widely used one-month and three-month SIBOR after Dec 31, 2024. Following the transition, SORA will be the key interest rate benchmark for the Singapore Dollar (SGD) financial markets.

Getting your home loan with the best packages will be timely.

What do these all mean?

For instance, Singaporeans buying their second residential property must now pay 17% ABSD, up from 12% previously. Foreigners buying any residential property are subject to a 30% rate, up from 20%. Entities are subjected to 35% ABSD plus a non-remittable additional 5% cent for housing developers.

The TDSR threshold was tightened to 55%, from 60% previously. That means new mortgages cannot cause borrowers' total monthly loan repayments to exceed 55% of their monthly income. The TDSR threshold for refinancing existing property loans granted before Dec 16, 2021 remains at 60%

Statistical trends across the Private & HDB Index

Private Property Index - still on a rising trend

Private home prices in Singapore jumped 5.0 percent quarter-on-quarter in the three months to December of 2021, quickening sharply from a 1.1 percent rise in the previous period, a preliminary figure showed. This marked the seventh straight quarter of increases in private home prices and the strongest growth since 2009, which prompted the government to introduce cooling measures in December, including raising additional stamp duties for second-home buyers and foreigners purchasing private residences, amid concerns over affordability. Prices rose faster for both landed properties (3.7 percent vs 2.6 percent) and non-landed properties (5.4 percent vs 0.7 percent). For the full year of 2021, private home prices rose by 10.6 percent, picking up strongly from a 2.2 percent increase in 2020.

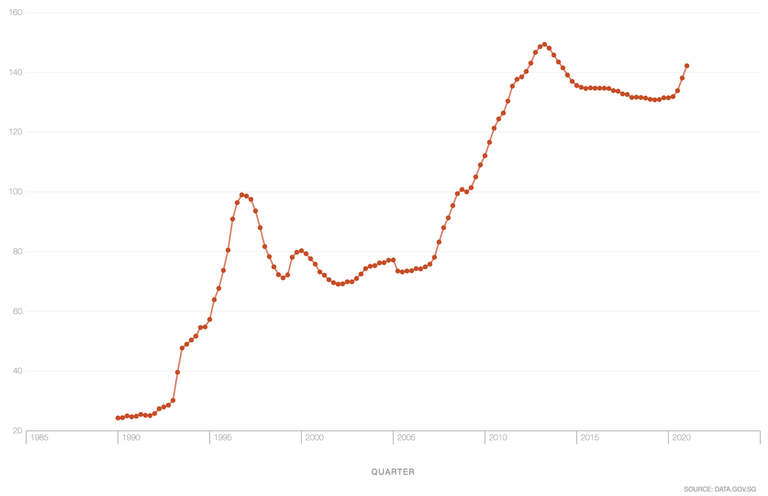

HDB Price Index - stabilising to bullish trend

Tracks the overall price movement of the public residential market. The index is based on quarterly average resale price by date of registration. The index till 3Q2014 was computed using stratification method, while that from 4Q2014 onwards is computed using the stratified hedonic regression method. 1Q2009 is adopted as the new base period with index at 100. The index from 1Q1990 to 3Q2014 are rebased to the new base period at 1Q2009. Indices from 1Q1990 to 3Q2014 are re-scaled using a factor of 100 (new index in 1Q2009) / 138.3 (original index in 1Q2009) multiplied on the original index level to derive the re-based index level for the respective quarters. Due to rounding, there could be some differences in the quarterly price change compared to the RPI series before re-scaling

Outlook towards 2022

Real estate sales will primarily be driven by buyers who are less affected by the latest cooling measures, such as Singaporean and permanent residents buying their only residential property in Singapore. Therefore, the buying demand will be mainly from the owner-occupiers. Other factors such as the tighter property market curbs, possible interest rate hikes and the ongoing pandemic could weigh down the property market. Among all these factors, the latest round of cooling measures is a major influence that would greatly increase the level of uncertainty in the local property market. The silver lining is that although the Omicron variant of the coronavirus is more contagious than the earlier variants, it is not deadlier than the Delta variant, which was the previous dominant variant of this virus globally.

This means that if no other deadlier variants of the virus were to emerge in the near future, the current pandemic may not have an even greater adverse impact on the real estate market than what had already occurred. Considering all the factors, the private residential property price index could increase within the range of 0% to 3% year-on-year in the next 12 months. As the latest round of cooling measures will have the least effect on the HDB resale market and they do not address the supply-chain problems in the construction of HDB BTO flats. The government’s response to the hot HDB resale market is to ramp up the supply of BTO flats in the next few years, rather than to curb demand. Curbing the demand for public housing will be highly unpopular with the people because for a large majority of Singaporeans, public housing is the only type of housing that they can afford. In the short term, the prices of HDB resale flats could still increase within the range of 1.4% to 2.5% each quarter. However, if the shortage of manpower and materials in the construction industry gradually eases sometime this year, and the potential BTO applicants become more confident of getting the keys to their new flats within a more reasonable time of 3 to 4 years, the increase in the supply of new BTO flats will have a decelerating effect on the growth of the resale prices of HDB flats.

ERA Realty Research & Consultancy

What are some factors to considering before renting out and/or renting a place?

As a landlord, are you looking to maximise the rental yield, are you purchasing in a location that has a high occupancy rate? For renters, are you looking for a shared space, an entire home. What are some ideals you are looking at for your desired home for the season.

As a Landlord

I want to know how things like how many tenants can i rent out to? What are my rights, what are some obligations pertaining to the tenancy agreement.

Check status of tenant/ tenants

Yes, as a landlord and with the help of a trusted realtor, you are and should check the following before signing on the tenancy agreement.

Ask to see a valid work permit or a student pass. You can check the validity of an employment pass online, and you can visit the Immigration & Checkpoints Authority (ICA) website to check on student passes.

Other information that you can request are employment income, previous tenancy lease experience (if any tenant has broken any lease).

Maximum number of tenants

According to URA rules, the maximum number of permissible tenants allowed for private housing is six unrelated individuals. Additionally, caregivers and domestic helpers are treated as belonging to one family.

If you’re a master tenant and the landlord has allowed you to sublet a room, the property’s total occupants should not exceed six.

Also, please take note that you are prohibited from creating additional bedrooms by installing partitions or dividers

Landlord's Rights

As a landlord, you can sell off your rented property if you do desire to. The tenancy can still continue as per tenancy agreement contract with the next owner transferring from Privity of Estate to Privity of Contract. A landlord owns the property but has to give exclusive possession, quiet enjoyment during the whole term of the unit being leased out.

Obligation to Tenancy Agreement

Landlords are bound by the tenancy agreement to ensure that you provide a safe, habitable space for your tenants. However, there are cases which you can evict a tenant. Failure to pay rent, causing damage to property, conducting illegal activities e.g subletting to illegal immigrants.

As a Tenant

When it comes to finding a place for the season, you will want a place you can call home and to feel comfortable and apart of. Here are some ideal considerations before choosing your rented home.

Budget

Setting aside a fixed amount every month for rental from your pay check does take a pinch. As a general rule, your emergency fund should be able to cover 3 to 6 months’ worth of living expenses (including rent), in case you lose your income. Make sure not to set a rental budget so high that you’re unable to maintain it, should something happen

Length of lease

The minimum length of lease in Singapore is six months for HDB flats, to a maximum lease of three years. For private properties, the lease must be for at least three consecutive months. There is no daily or weekly leasing allowed.

Some landlords will agree to lower the price, if you sign a longer lease. However, if you’re brand new to Singapore, it may be a good idea to sign only the minimum lease for your very first property. This will give you the chance to switch accommodations, after you get a sense of your surroundings.

Lifestyle, location, accessibility, amenities

Would the area suit your needs. for example, if you are working from home often, it will be nice to have shops like grocery stores, coffee shop, medical clinics etc. If you do not mind being nestled away from the crowd, For private condominiums, would the facilities and amenities be sufficient for you and your family.

Current state of home

A big factor for most tenants will be a ready to move in fully furnished unit vs an unfurnished unit. Do remember to ensure the inventory list is checked before the handover and check all condition of fixtures & fittings.